Australia: A Strong Export Market for U.S. Food & Beverage Manufacturers

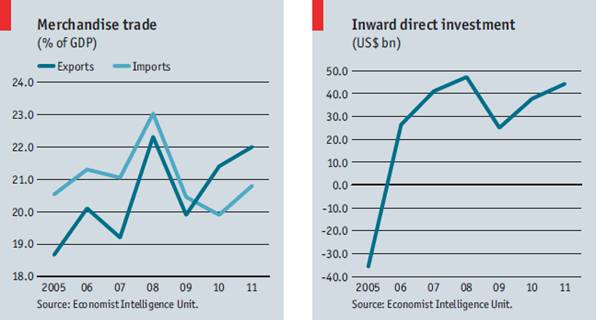

Australia has one of the world’s strongest developed economies, with a 2011 GDP of US$926.2 billion and expected continuing growth. Similar to the U.S. and Western Europe, GDP derives mainly from services (71.3%), followed by industrial (24.9%). It has a small but powerful agricultural and food processing sector (3.8%) which competes with U.S. food and beverage brands in several export markets.

Despite a population of only 23 million, many of the regions are very prosperous. The eastern part of Australia (Sydney, Melbourne, Brisbane) is home to the majority of Australia’s service and financial industries. Western Australia (Perth) controls the majority of Australia’s natural resources including iron ore, gold, oil and natural gas. Recently the mining sector has grown significantly and attracted foreign investment. A collapse in exports of minerals and other natural resources would severely impact the Australian GDP growth. Australian food exports are also vulnerable to extreme weather, such as droughts and floods, which have become increasingly severe in past years.

The food and beverage industry generated total sales and service income of approximately US$93 billion in 2009-10, whereas the total value of food retailing in 2011 was US$122.5 billion. The food and beverage industry represents 26.1% of the total Australian manufacturing industry, second only to mining. Australia imported US$10.3 billion of food and beverage products in 2011 (excluding retail sales of U.S.-based foodservice chains such as McDonald’s).

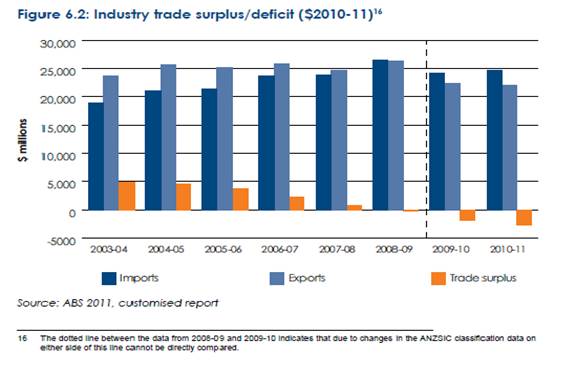

Though overall merchandise trade experienced a trade surplus, food and beverage imports exceeded exports by US$2.6 billion. This was due to both a strong Australian dollar as well as a decline in exports.

The Australian food and beverage industry’s trade deficit increased by 48.5%, from US$2 billion in 2009-10 to US$2.8 billion in 2010-11, and this is expected to continue as U.S. and European food and beverage brands enter the market.

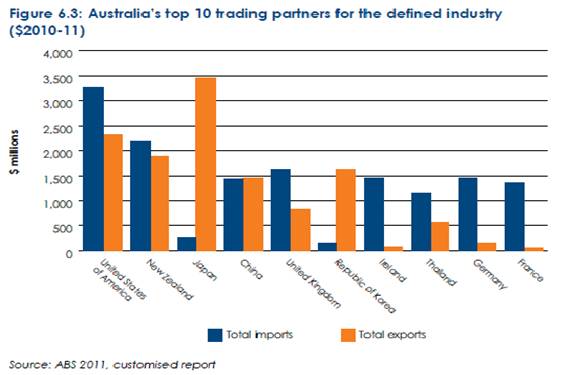

New Zealand remains the major source of Australia’s food imports, accounting for US$2 billion or 18.7% of total Australian food imports in 2010—11 (Figure 26). The main countries gaining market share in Australia’s food import market in 2010—11 were the United States, Thailand, Singapore and Malaysia. The U.S. is the second largest supplier of imported consumer ready foodstuffs to the Australian market, holding a 12% share valued at over $931 million in 2011. Primary imports of U.S. processed food included nuts, fruits and fruit juices, seafood, snack foods and confectionery.

Since 2005, the U.S. and Australia have enjoyed a free trade agreement (AUSFTA), making food and beverage imports from the U.S. duty-free. All imported food is monitored by the Australian Quarantine & Inspection Service (AQIS). It is the responsibility of the importer to ensure that all food they import complies with these requirements. Most Australian food and beverage importers are well aware of these standards, all of which are available on the Food Standards Australia New Zealand (FSANZ) website (http://www.foodstandards.gov.au/). As a result of a track record of compliance with these import regulations, U.S. processed foods and foodservice chains enjoy a positive consumer perception, an asset that savvy American brands exploit successfully.

American food, beverage and agricultural processors should consider this robust export market “Down Under.” While there are many competitive Australian brands, innovative U.S. companies with a unique product can carve a prosperous niche in this thriving market.

Peter M. Guyer

Athena Marketing International (AMI) is a export marketing, business development, & consulting firm serving U.S. food, beverage & consumer products manufacturers.

Tel. +1 (206) 749-9255